Unifiedpost reports strong progress with its European expansion

PRESS RELEASE - Regulated information

La Hulpe, Belgium – September 17, 2021, 7 a.m. CET, Unifiedpost Group (Euronext: UPG) (Unifiedpost, the Group or the Company) is pleased to announce its second-quarter and half-year results for the period to June 30, 2021.

Highlights

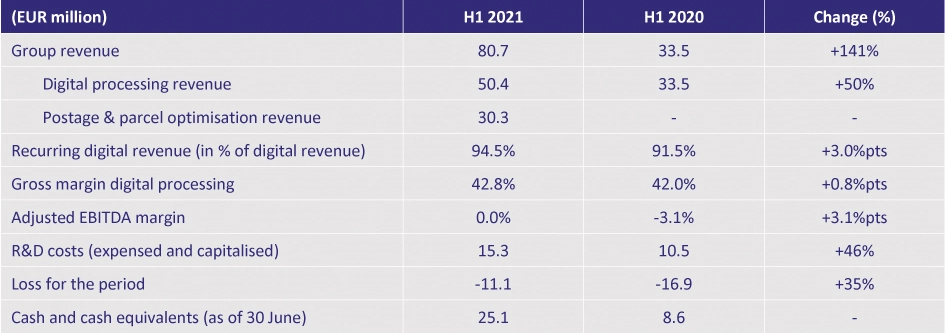

- Group revenue more than doubled to €80.7 million driven by acquisitions in the period

- Organic digital processing revenue growth of 13% y-o-y in Q2 2021, up from 10% y-o-y in Q1 2021

- Post-IPO acquisition strategy completed and integration of six acquisitions during period is at advanced stages

- Gross margin of digital processing business increased by 0.8%pts y-o-y while adjusted Group EBITDA (1) improved to achieve break-even

- Cash and equivalents of €25.1 million with a further €28.7 million available in undrawn-financing sufficient to fund future development

- Company guidance for FY 2021 and years to come confirmed

(1) Adjusted EBITDA for a period, as EBITDA plus share-based payment expense, non-recurring operational expenses, acquisitions expenses, costs in relation with the Company’s listing, less other income and expenses.

Commenting on the results, Hans Leybaert, CEO and Founder stated: “As we celebrate our first anniversary as a public company, I am proud of what our teams have achieved across Europe. With six acquisitions completed since the IPO, we have welcomed new colleagues, added new geographies, capabilities and customers large and small. This will enable us to enhance our offering and rapidly scale our network. I am confident that we now have in place the platform that will lead the digital transformation of document, identity, payments and related financial services for European SMEs. Our focus is now to raise organic growth. This will be done by further integration of the acquired companies generating additional sales, creating new ecosystems and speeding the network effects of the platform. Our communication and payments network is being rolled out across 30 countries and we are welcoming more new customers than ever before while growing the volume of services we offer to individual customers faster than ever before.”

Key Q2 figures

Key H1 figures

Revenue growth accelerated on the back of organic growth and acquisitions

For the first half to June 30, 2021, Unifiedpost more than doubled its consolidated revenue to €80.7 million y-o-y, largely driven by the acquisitions completed in the period. Digital processing revenue, the core business of Unifiedpost, grew to €50.4 million, an increase of 50% y-o-y. Group revenue continued to be affected by COVID-19, notably in the UK, Belgium and Slovakia. However, this is expected to diminish in the coming quarters as economic activity resumes. In H1 2021, 94.5% of the digital processing revenue was recurring. This provides, together with the limited customer churn, a stable base for continued growth.

Transaction fees increased by 187% y-o-y to €65.6 million due to the contribution from recent acquisitions, while subscription fees increased 44% y-o-y to €9.3 million fuelled by an increase in SME customers.

Gross profit for the first half amounted to €24.9 million compared to €14.1 million in the previous year’s period. Excluding contribution from acquisitions, like-for-like gross profit for the period was stable. Approximately 87% of the Group’s gross margin was generated by digital processing. The growth margin of this business saw an increase from 42% to 42.8%.

Unifiedpost continues to invest in its platform development through upgrades and developments of additional services. During the first half of the year, the Group spent €15.3 million in R&D (of which 57% was capitalised and 43% expensed), equivalent to 30% of total digital processing revenue.

G&A expenses for the period increased from €13.1 million to €18.6 million compared to the previous year due to a higher number of employees and the Group’s general expansion, including its acquisitions. Sales & Marketing expenses were up from €5.0 million to €11.3 million, reflecting the Group’s commercial efforts in the first half of the year.

Due to the improvement in margins, the Group reported a significant reduction in its loss for the period of €5.8 million compared to the same period in the previous year.

During the first six months of the year the Group completed six acquisitions for a total consideration of €146.6 million with €81.9 million in cash and €53.8 million through the issuance of new equity and € 6.9 million repayment of loans.

At the end of the period, the Group cash position was €25.1 million (cash and cash equivalents) in addition to approved and undrawn facilities totalling €28.7 million. The group has sufficient resources to continue to fund its capital expenditure and debt commitments.

Unifiedpost’s equity increased from €168.2 million to €211.9 million in the reporting period. €53.8 million of this was attributable to the issue of shares in connection with the acquisitions made by means of a contribution in kind of vendor loans.

Management guidance confirmed

Following strong growth in the second quarter and further anticipated acceleration into the second half of the year, Unifiedpost reiterates its FY2021 organic revenue growth forecast of at least 15% in its digital processing revenue. For FY2022 and FY2023 Unifiedpost also confirms the guidance provided in April 2021, with organic digital processing revenue growth of 25% for FY2022, stepping up to 30% in FY2023. Management also reaffirms digital processing revenue gross margin guidance of +60% by 2023 and an adjusted EBITDA margin expected to exceed 25% by FY2023.

Digitalising the financial supply chain processes

Unifiedpost enables members of its business network to interact digitally, exchange documents, execute payments and optimise cashflows all via Unifiedpost’s integrated platform. The Company’s ambition is to become the leading player in the ongoing digital transformation and to create an unrivalled pan-European business network. The taken path of geographical expansion, additional network effects and increased digitisation gives Unifiedpost an excellent position to achieve this goal.

Building a pan-European ‘one-stop-shop’

The integration of the six acquisitions is advancing well. The teams involved, including the local management from acquired companies, have been successfully retained, preserving high-value knowledge and experience, facilitating the financial and business integration of all the companies to plan. Consequently, the roll-out and migration of customers to the Unifiedpost premium SME platform has already commenced.

Unifiedpost’s premium SME solution has been rebranded to ‘Banqup’ to streamline marketing efforts. The management’s intention is to gradually phase out legacy brands such as ‘Billtobox’. The speed of the roll-out of Banqup has exceeded expectations, from two countries at the end of March, to 13 at present, with plans to roll this out to 30 countries by the end of year – four more than originally planned (additional countries include Croatia, Slovenia, Portugal and Austria).

Growing the network

Unifiedpost has set ambitious targets for new customer onboarding. At the end of the period, the organic new customer growth across the network was 41% y-o-y and 16% compared to the end of December 2020. The consolidated network, including the businesses and customers of the acquired companies, expanded to over 980,000 companies, representing an estimated 4% of SMEs in Europe.

In Belgium the number of customers on Billtobox grew by 45% y-o-y at H1 2021. Encouragingly the number of transactions grew even faster than that of the customers, demonstrating the improved adoption of the platform. The number of transactions in the first half of 2021 increased 67% compared to the previous six months, and 170% compared to the same period last year. Unifiedpost has created new business ecosystems through agreements with new partners and wholesalers to offer its SME solution to their customers, the largest representing approximately 80,000 customers.

In France the focus was on the integration of JeFacture with the various IT systems. This preparatory work is key to be ready to welcome the flow of enterprises that will have to join the platform before the end of 2022 as the obligation to dematerialise all B2B invoices in France starts to be being enforced as from the 1st of January 2023. The ecosystem of JeFacture is getting enriched by key partnerships with, amongst others, ACD (3rd largest accounting solution), RCA (intranet / extranet solution) and Effiz (a middleware between JeFacture and several accounting software’s). JeFacture.com will be presented jointly with several new partnerships and new features announcements by ECMA during the yearly CPA congress between the 6th and 8th of October 2021.

Growing payment service adoption

Unifiedpost invoice payment solutions are adopted more and more by the platform users. In total 292,312 payment transactions were processed between business partners on the platform during the period, an increase of 71% y-o-y, representing a total payment value of €51.5 million, equivalent to €176 on average per payment. During the period the Unifiedpost multiple bank portal for corporates handled 32 million payment transactions for the customers (credit transfers and direct debits together), representing a payment value of €12 billion.

Investors, analyst & media webcast:

Management will host a live video webcast for investors and media today at 2 p.m. CET.

A presentation can be followed via live webcast. A recording will be available shortly after the event.

To attend, please register at https://attendee.gotowebinar.com/register/6187452624717239308

A full replay and a copy of the slides will be available after the webcast at: https://www.unifiedpost.com/en/investor-relations

Financial Calendar

- Publication 2021 Q3 business update: November 19, 2021

- Investor Day: December 1, 2021

Enquiries

Hans Leybaert, CEO Laurent Marcelis, CFO

+32 477 23 94 80 +32 477 61 81 37

hans.leybaert@unifiedpost.com laurent.marcelis@unifiedpost.com

Investor Relations & Media

Sarah Heuninck

+32 (0)491 15 05 09

sarah.heuninck@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business services built on Documents, Identity, Payments and associated finance services. Unifiedpost operates and develops a comprehensive cloud-based platform for administrative and financial services that allows real-time and seamless connections between Unifiedpost’s customers, their suppliers, their customers, and other parties along the financial value chain. With its one-stop-shop solutions, Unifiedpost’s mission is to make administrative and financial processes simple and smart for its customers. Since its founding in 2001, Unifiedpost has grown significantly, expanding to offices in 30 countries, with more than 400 million documents processed in 2020, reaching over 980,000 SMEs and more than 2,500 Corporates across its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- Revenue of €146 million (pro-forma 2020)

- 1,300+ employees

- 400+ million documents processed in 2020

- Diverse portfolio of clients across a wide variety of industries, including banking, leasing, utilities, media, telecommunications, travel, social security service providers, public organisations, ranging from SMEs to large corporates.

- Unifiedpost Payments, a fully owned subsidiary, is recognised as a payment institution by the National Bank of Belgium

- Certified SWIFT partner

- M&A track record of 17 acquisitions in last 9 years

- Quoted on the regulated market of Euronext Brussels, symbol: UPG

(*) Warning about future statements: The statements contained herein may contain forecasts, future expectations, opinions and other future-oriented statements concerning the expected further performance of Unifiedpost on the markets in which it is active. Such future-oriented statements are based on the current insights and assumptions of management concerning future events. They naturally include known and unknown risks, uncertainties and other factors, which seem justified at the time that the statements are made but may possibly turn out to be inaccurate. The actual results, performance or events may differ essentially from the results, performance or events which are expressed or implied in such future-oriented statements. Except where required by the applicable legislation, Unifiedpost shall assume no obligation to update, elucidate or improve future-oriented statements in this press release in the light of new information, future events or other elements and shall not be held liable on that account. The reader is warned not to rely unduly on future-oriented statements.