Overview of recent financing of Unifiedpost by Francisco Partners

Press release - Regulated information

La Hulpe, Belgium – June 14, 2022, 7:00 a.m. CET – [INSIDE INFORMATION] Unifiedpost Group (Euronext: UPG) (Unifiedpost, the Group or the Company) wants to clarify the senior facilities agreement it has concluded on March 7, 2022 with U.S. investment firm Francisco Partners. In this respect, the Company publishes a consolidated clear overview of the main characteristics of the aforementioned agreement in order to fully inform the market.

Why this financing?

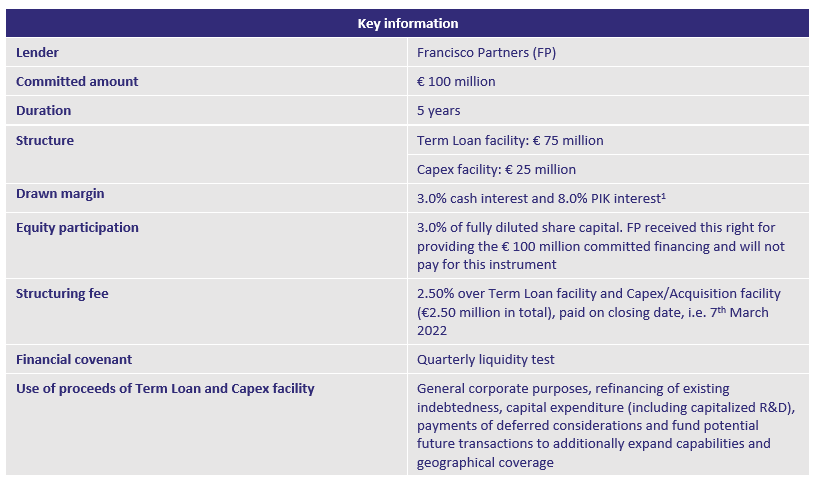

On 7 March 2022, Unifiedpost signed a €100 million five-year senior facilities agreement provided by Francisco Partners (the SFA). The SFA will allow Unifiedpost to do all necessary investments to be ready with a pan-European full service digital invoicing solution in time to ride the wave of digitization that will roll across Europe. In the coming 18 months in no less than 10 countries, all key Unifiedpost markets, B2B/ B2G e-invoicing will become mandatory. Unifiedpost’s target group – which consists of 25 million SMEs and as many self-employed people in the EU – will be obliged to send out their invoices in a digital manner.

The proceeds will be used to refinance existing debt and further support Unifiedpost’s growth strategy in terms of R&D investments, working capital requirements, and the funding of potential future transactions to additionally expand capabilities and geographical coverage. Any potential acquisitions will be evaluated in function of strengthening the Company’s local market position in key countries. In doing so, Unifiedpost aims to offer all its shareholders and the financial markets guarantees for further strategic implementation and for the further valorisation of our organic growth potential.

Lender: Francisco Partners

The SFA is provided by Francisco Partners, a leading global investment firm that specializes in partnering with technology-enabled businesses.

As part of the transaction, Francisco Partners obtained an equity fee commitment under a subscription agreement in the amount of €12.756 million in consideration for the commitment by FP to enter into the SFA. This fee was deducted on 10 March 2022 by way of set-off from the proceeds of the first drawdown under the SFA. Pursuant to the subscription agreement, FP subscribed to 3% of the share capital of Unifiedpost Group, representing € 12.756 million of the share capital by means of a contribution in cash in return for 1,082,862 new shares, at a subscription price equal to € 11.78 per share (being the 30 day weighted average closing price of the Company’s shares admitted to trading on Euronext Brussels on the day prior to entering into the SFA).

This capital increase in cash was completed on 18 March 2022. Following the issuance of these new shares, the share capital has increased from € 309,219,448.52 to € 321,975,562.88 and the total number of shares amounts to 34,546,431. Each of these shares gives one voting right at the general meeting of shareholders. This emphasises Francisco Partners’ long-term commitment to Unifiedpost’s business model and growth strategy.

Hybrid character of the financing

The financing scheme draws its hybrid character from the fact that the financing transaction entails both an equity participation of 3% of the share capital of Unifiedpost by the lender, and the fact that the loan bears a 3% cash interest and 8% interest paid in kind (2).

Breakdown of the credit and equity financing

The funds received at Closing Date amount to €75 million (€62.3 million under the SFA and €12.7 million by means of a contribution in cash in return for shares). They will be (or are) used as follows:

- €30 million to cover R&D expenditures;

- €20 million for refinancing of existing indebtedness;

- €25 million as a buffer for potential risks inherent to the Company’s business.

The remaining €25 million of the SFA remains undrawn without costs and remains available for future additional investments.

Duration

The term is 5 years. After two years this can be redeemed without a prepayment penalty.

Structure

A Term Loan facility of € 75 million and a Capex facility of € 25 million entails a loan that must be used for capital expenditure (3). This Capex facility is available for 24 months from the closing date. There is no commitment fee applicable in case this facility is not drawn.

Covenant details

Quarterly liquidity test of a minimum of € 20 million, to be decreased to €12.50 million when certain revenue thresholds are triggered (4).

Why hybrid financing?

Unifiedpost believes that in order to achieve its goal, a hybrid financing is the preferred solution. Traditional financing was available, but not tailored to the current growth phase and financing needs of Unifiedpost. Francisco Partners is a partner who understands the Company’s goal and guarantees a high degree of contractual flexibility and solid financial foundations until Unifiedpost’s cash flow reaches break-even, as expected in the second half of 2023. This is another reason why the Company has chosen to bring hybrid financing forward so it can bridge this period.

Unifiedpost was assisted by Nielen Schuman as debt advisor and Linklaters LLP.

(1) Pay in kind: interest to accrue at the end of the interest period and to be added to the notional

(2) The Company may, in its sole discretion, elect to pay all or any part of any PIK interest rate in cash rather than accrue such amount at the end of the relevant interest period, i.e. a 3 or 6 months period to be selected by the Company. The amount accrued cannot be converted into shares.

(3) Capex facility entails a loan that can be used for capital expenditure (i.e. investment in physical assets).

(4) until the first date on which either LTM subscription revenue is € 25,000,000 (or more) or LTM recurring digital processing revenue is € 110,000,000

<End>

Financial Calendar 2022

- 12 August 2022: Publication H1 2022 Business Update

- 16 September 2022: Publication H1 2022 Financial Results

- 10 November 2022: Publication Q3 2022 Business Update

Enquiries

Hans Leybaert, CEO

+32 477 23 94 80

hans.leybaert@unifiedpost.com

Laurent Marcelis, CFO

+32 477 61 81 37

laurent.marcelis@unifiedpost.com

Investor Relations & Media

Sarah Heuninck

+32 491 15 05 09

sarah.heuninck@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business services built on “Documents”, “Identity” and “Payments”. Unifiedpost operates and develops a 100% cloud-based platform for administrative and financial services that allows real-time and seamless connections between Unifiedpost’s customers, their suppliers, their customers, and other parties along the financial value chain. With its one-stop-shop solutions, Unifiedpost’s mission is to make administrative and financial processes simple and smart for its customers. Since its founding in 2001, Unifiedpost has grown significantly, expanding to offices in 32 countries, with more than 500 million documents processed in 2021, reaching over 1,600,000 SMEs and more than 2,500 Corporates across its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2021 turnover € 171 million

- 1400+ employees

- Diverse portfolio of clients across a wide variety of industries (banking, leasing, utilities, media, telecommunications, travel, social security service providers, public organisations, etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol: UPG

(*) Warning about future statements: The statements contained herein may contain forecasts, future expectations, opinions and other future-oriented statements concerning the expected further performance of Unifiedpost Group on the markets in which it is active. Such future-oriented statements are based on the current insights and assumptions of management concerning future events. They naturally include known and unknown risks, uncertainties and other factors, which seem justified at the time that the statements are made, but may possibly turn out to be inaccurate. The actual results, performance or events may differ essentially from the results, performance or events which are expressed or implied in such future-oriented statements. Except where required by the applicable legislation, Unifiedpost Group shall assume no obligation to update, elucidate or improve future-oriented statements in this press release in the light of new information, future events or other elements and shall not be held liable on that account. The reader is warned not to rely unduly on future-oriented statements.